Mutual Federal Digital Banking offers a robust user experience that offers helpful options and features in both the online desktop and mobile app environments.

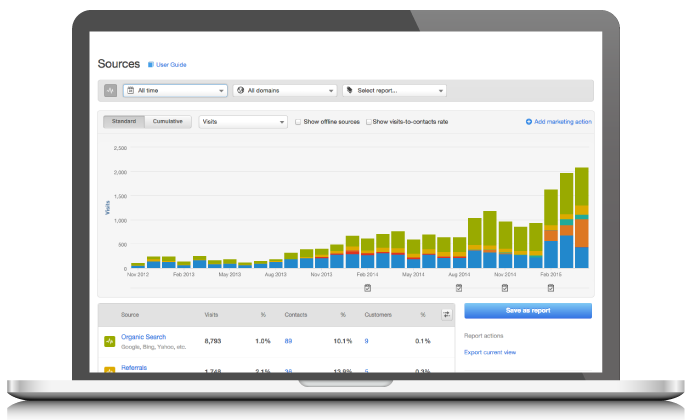

★ FINANCIAL TOOLS:

Populate all your financial accounts into one convenient dashboard.

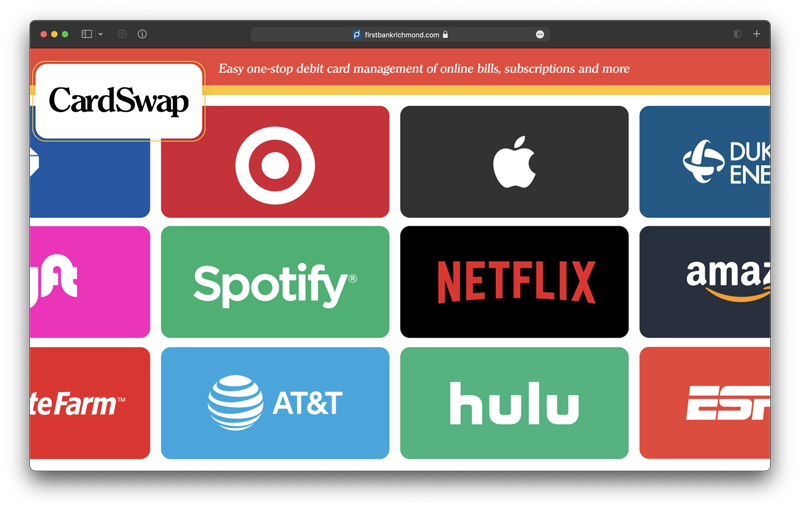

★ CARD SWAP:

Apply and monitor your debit card information across your favorite subscriptions and digital point of sale services in a single workflow.

★ CHECK DEPOSIT:

Deposit checks instantly by using your mobile camera features.

State-of-the-art digital banking services, including Financial Tools, External Transfers, Goal Setting, CardSwap and much more. All in a clean, intuitive interface.

Get an overview of your accounts, see account activity, download banking transactions, view eStatements, and more on the dashboard page.

Move your money whenever and however you want. Pay your loan, schedule transfers, or move money immediately between your accounts including those to reach your savings goals. You now have the ability to set up accounts within your online banking account to save for goals such as your dream vacation or home remodel.

(Goal-setting feature coming soon!)

Apply and monitor your debit card information across all your favorite subscriptions and digital point of sale services in a single workflow. CardSwap allows you to update all your favorite digital services, like Netflix, Amazon, and more in one convenient place, using one payment method. This makes it easier to replace lost cards, or to open and use new accounts.

Control your spending and protect yourself against fraud with our mobile app.

With Card Control, not only can you turn your card off and on, you can also set controls and alerts by channel (in-store, online, mobile, ATM, etc.), set spending limits, select geographic locations where your card can be used, and much more.

Paying people digitally through your mobile device is not only efficient but very safe. Whether you're going dutch for dinner, sharing an Uber, or paying the babysitter, People Pay makes sending and receiving money simple and convenient.

First Bank Richmond has been a tremendous supporter and community partner for the Cardinal Greenway back to our early days when the trail was being built in Wayne County. Having celebrated our 25th anniversary in 2018 they're still one of our biggest supporters from event sponsorship to having their team members volunteer and serve on various committees. First Bank's support has been instrumental to the growth and success of the Greenway and we look forward to the partnership continuing for another twenty-five years and beyond.

-Brian S., Cardinal Greenways

Click "Enroll in Online Banking" at the top of the Online Banking page and complete the enrollment form.

You will be asked to provide the following information depending on your account type:

ATM or Debit Card - your card number and personal identification number (PIN)

Checking, Savings, Money Market, CD or HSA - your account number and last statement balance

Loan Account or Line of Credit - account number, last payment amount and original principal amount

Upon completion, you may receive instant online access. If you have more than one account, you will get access to your other accounts as well. However, if additional processing time is required, you will receive a notification from us by e-mail before you can access your account(s).

Multi-Factor Identification increases your level of protection online. Not only will your password and user ID be recognized, but your computer will be recognized as well. If we don't recognize your computer - you've logged in from a public computer, one you haven't used before, or you have cleared your browser history/cookies - you will be prompted to provide information only you will know. This step acts as an additional line of defense against unauthorized access to your accounts.

Usernames and passwords are case sensitive. Verify that you are entering your information exactly as you created it.

For security purposes, online and mobile accounts are locked if the wrong password is entered three times. If you have entered the wrong information or forgotten your username/password, contact a branch or customer service to have one of our team members unlock your account.

To verify that a payment has been sent, from your navigation links, click View Bill Payment Reports. From the Reports title list box, select the appropriate report and click Generate Report. You can also create a new report or edit an existing report.

From the Make Payments screen, you can also see pending payments and the last 5 processed payments at a glance.

SecurLOCKTM Equip allows you to:

Turn your First Bank debit card on and off completely or by channel (such as in-store, online, mobile, ATM, etc.);

Set spending limits on your debit card to help you manage your spending, or as a parental control;

Control which merchant types your card can be used at (such as department stores, gas stations, restaurants, etc.);

Receive alerts and transaction history;

And elect to receive a notification every time your debit card is used.

In order to use mobile check deposit, your account must be open for at least 30 days, and you cannot have more than two overdrafts in the current statement cycle or six overdrafts within the prior 12 months. Checks to be deposited through mobile banking must be made payable to the account owner.

Above your signature endorsement on the back of your check, write "For Mobile Deposit Only, First Bank Richmond". Next, log into your mobile banking app, click the "+" to navigate to Deposits, and follow the on-screen instructions.

Mobile deposits are limited to $2,500 for one day, or $3,500 over a period of five consecutive business days. Any items presented in excess of the limits will be returned at our discretion.

Yes, the mobile banking service utilizes best practices such as HTTPS, 128-bit SSL encryption, device profiling, biometric or password access and application time-out when your mobile device is not in use. Only the mobile devices that you personally enroll in the service can access your accounts. In addition, no account data is ever stored on your mobile device.

In the event your mobile device is lost or stolen, the service can be immediately disabled by either signing in to online banking and accessing the manage mobile banking settings under the customer service tab or by calling us. Then contact your service provider immediately to stop all wireless service.

121 S. Ohio Avenue

Sidney, OH 45365

Routing Number: 274970791

If you use links provided on the Mutual Federal website that redirect to a third party website, you are acknowledging that you are leaving www.mutualfederal.com and are going to a website that is not operated by Mutual Federal, a division of First Bank Richmond. Mutual Federal is not responsible for the content or availability of linked sites. Mutual Federal does not represent either the third party or the visitor if a transaction is entered. In addition, privacy and security policies may differ from those at Mutual Federal.